Getting The Estate Planning Attorney To Work

Getting The Estate Planning Attorney To Work

Blog Article

The Best Strategy To Use For Estate Planning Attorney

Table of ContentsEstate Planning Attorney Fundamentals ExplainedNot known Details About Estate Planning Attorney Some Known Facts About Estate Planning Attorney.Everything about Estate Planning Attorney

Estate planning is an action plan you can utilize to identify what occurs to your possessions and responsibilities while you live and after you pass away. A will, on the various other hand, is a lawful paper that lays out just how assets are distributed, who cares for children and animals, and any type of various other desires after you die.

Claims that are rejected by the executor can be taken to court where a probate judge will certainly have the last say as to whether or not the case is legitimate.

Examine This Report about Estate Planning Attorney

After the inventory of the estate has actually been taken, the worth of possessions determined, and taxes and debt paid off, the executor will certainly after that seek authorization from the court to disperse whatever is left of the estate to the recipients. Any inheritance tax that are pending will come due within 9 months of the date of fatality.

Each specific locations their assets in the trust and names a person various other than their spouse as the beneficiary., to sustain grandchildrens' education and learning.

The 3-Minute Rule for Estate Planning Attorney

This approach involves freezing the worth of a property at its value on the day of transfer. Appropriately, the quantity of possible capital gain at death is likewise iced up, permitting the estate planner to estimate their possible tax obligation liability upon death and much better prepare for the settlement of income tax obligations.

If enough insurance earnings are offered and the plans are effectively structured, any kind of income tax on the deemed dispositions of possessions complying discover this info here with the fatality of a person can be paid without considering the sale of possessions. Profits from life insurance policy that are received by the beneficiaries upon the death check here of the guaranteed are generally income tax-free.

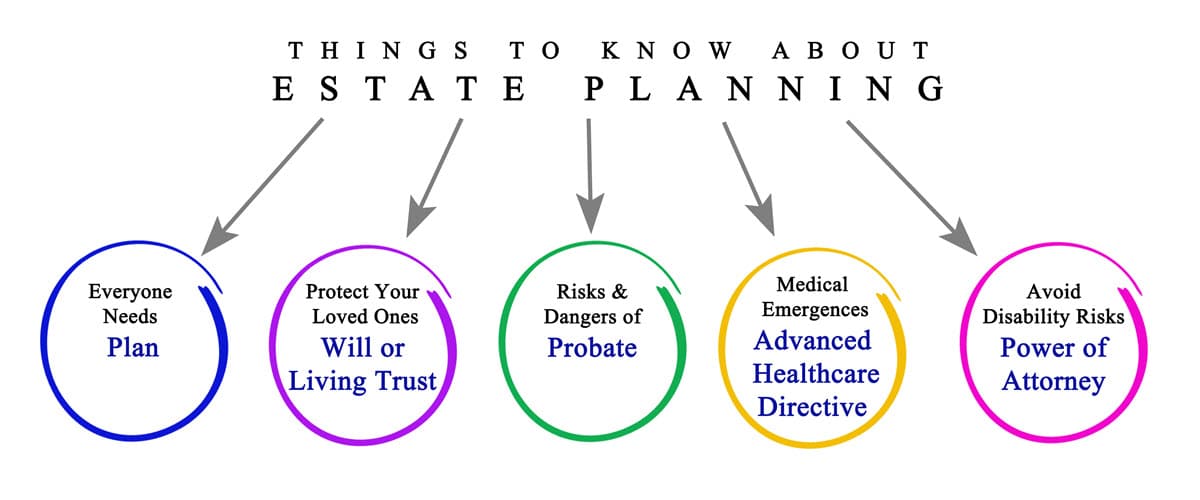

There are particular records you'll require as component of the estate planning process. Some of the most common ones consist of wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth individuals. But that's not real. Estate preparation is a device that everyone can use. Estate intending makes it much easier for individuals to establish their dreams before and after they pass away. In contrast to what lots of people think, it prolongs past what to do with possessions and responsibilities.

The Ultimate Guide To Estate Planning Attorney

You ought to begin preparing for your estate as quickly as you have any type of measurable possession base. It's a recurring process: as life advances, your estate strategy should shift to match your circumstances, according to your brand-new goals. And keep at it. Refraining your estate planning can trigger unnecessary financial problems to enjoyed ones.

Estate planning is usually considered a tool for the rich. That isn't the instance. It can be a valuable way for you to manage your properties and liabilities before and after you die. Estate planning is great post to read also an excellent means for you to set out strategies for the treatment of your small kids and family pets and to describe your want your funeral service and favorite charities.

Qualified applicants who pass the exam will certainly be formally licensed in August. If you're qualified to rest for the exam from a previous application, you may file the short application.

Report this page